ATM Skimming and How to Protect Yourself

ATM has become an irreplaceable communication and service channel between banks and cardholders due to its fast, convenience and human resource saving advantages. With the prosperity of installed ATM, the reported ATM crime also has been dramatic grown, causing big loss for cardholders and banks.

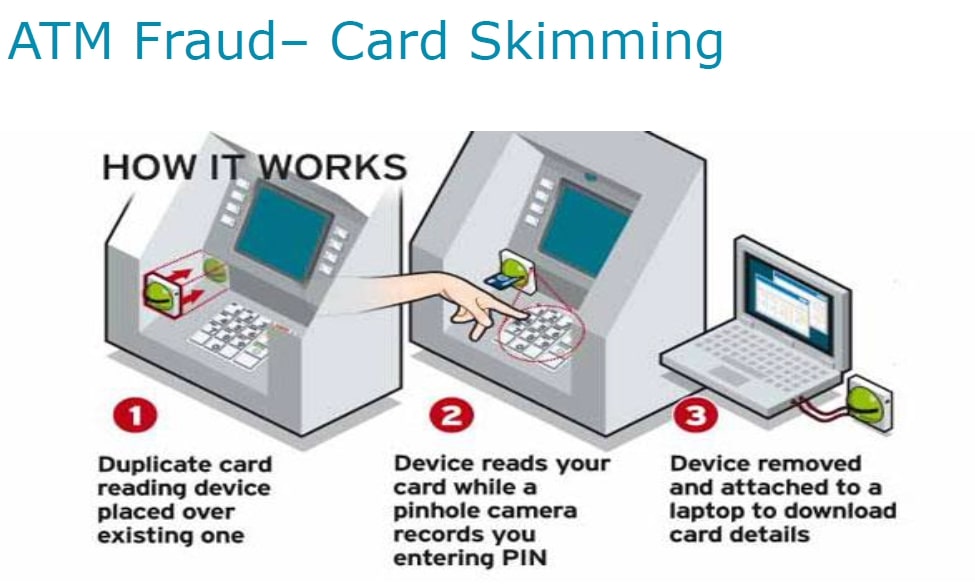

Card skimming is a type of card theft where crooks use a small device to steal card information in an otherwise legitimate credit or debit card transaction. When a credit or debit card is swiped through a skimmer, the device captures and stores all the details stored in the card's magnetic stripe. The stripe contains the card number and expiration date and the card holder's full name. Thieves use the stolen data to make fraudulent charges either online or with a counterfeit card. Often, the thieves will hide a small pinhole camera in a brochure holder near the ATM, in order to extract the victim’s pin number. This way the thieves get all the information needed to make fake cards and withdraw cash from the cardholder's account.

Many of the large data breaches that have occurred over the past few years may have contributed to ATM fraud. When criminals hack databases full of credit and debit card numbers they then use that information to pull the victim's bank account cash out at an ATM.

Types of ATM Skimming

ATM skimming comes in two flavors. In the first scenario, a device called a “skimmer” is placed on the face of an operational ATM. When a card is swiped, the skimmer records the data on the card, and a camera hidden in a brochure holder or security mirror records the PIN. Usually, money is dispensed and the user is none the wiser.

In the second scenario, a used ATM is rigged to record data, and placed in a public area. These ATMs are only semi-operational and do not dispense cash. These used ATMs can be purchased easily on the second-hand market at bargain prices.

How to Protect Yourself:

- Scrutinize the ATM: If you’re using your debit /credit card. Check the card scanner, if the scanner does not match the color and style of the machine, it might be a skimmer. You should also “shake” the card scanner to see if it feels like there’s something attached to the card reader on the ATM.

- Cover the keypad when entering your PIN: In order to access your bank accounts, thieves need to have your card number and your PIN. By covering the keypad, you prevent cameras and onlookers from seeing your PIN.

- Check your bank and credit card statements often: If someone does get your information, you have 60 days to report any fraudulent charges to your credit card company in order not to be charged. For a debit card, you only have about 2 days to report any suspicious activity.

- Be choosy: Don’t use general ATMs at bars or restaurants. These are not usually monitored and therefore, can be easily tampered with by anyone.

- Occasionally, certain retail and restaurant workers who handle credit /debit cards are recruited to be part of a skimming ring. These workers use a handheld device to skim your credit card during a normal transaction. For example, we routinely hand our cards over to waiters to cover the check for a restaurant. The waiter walks away with our credit cards and, for a dishonest waiter, this is the perfect opportunity to swipe the credit card through a skimmer without being detected.

Once the victim's credit card information is stolen, thieves will either create cloned credit card to make purchases in store, use the account to make online purchases, or sell the information on the internet. Victims of credit card skimming are often unaware of the theft until they notice unauthorized charges on their account, have their card unexpectedly declined, or receive an overdraft notification in the mail.

ATM Security

- Look around and observe your surroundings. If the machine is poorly lit, or is in a hidden area, use another ATM.

- Have your card ready. Avoid having to go through your wallet or purse to find your card.

- Make sure that anyone waiting to use the ATM after you cannot see you entering your PIN or transaction amount.

- Count your cash while withdrawing at the ATM. Put your cash, card, and receipt away immediately.

- Cancel your transaction and leave immediately if you see anything suspicious activity.

- Do not leave your receipt behind - take it with you. Compare your ATM receipts with your monthly statement. It is the best way to guard against unauthorized use of your card, and it makes record keeping easier for you.

- If you've lost your Visa card or your ATM card, contact the your financial institution that issued your card immediately.

Lost Card protection

Use your NMB Bank Debit Card to shop in a store, online or anywhere, and you are protected from unauthorized use of your Debit Card. With our “Zero Liability feature”, card holders’ liability for unauthorized transactions is zero.

Security for VISA Cards

Security at Point of Sale

Now you will be required to enter your ATM PIN while doing transactions at retail outlets. This will protect any unauthorized usage of your debit card.

Tips for security

- Keep your PIN a secret.

- Don't allow anyone else to use your card, PIN or other security information.

- Always memorize your PIN and never write it down.

- Always take reasonable steps to keep your card safe and your PIN secret.

- You should never be asked to disclose your PIN.

- Use your body or hand to shield the PIN pad on the terminal, so others at the checkout cannot see which numbers are being keyed into the PIN pad.

Online security

Your Debit Card is secure for online usage with a 6 digit numeric 3D Secure PIN – a password for online transactions

Register for 3D Secure PIN

3D Secure is a service that allows you to generate a 6 digit PIN to protect your debit card when you shop online; giving you added reassurance that only you can use your debit card.

Use a secure web browser

Look for an "s" after the "http" in the web page address or URL of the online store you are visiting for safe browsing and payments.

Keep your 3D Secure OTP PIN secret

Please do not disclose your 3D Secure OTP PIN to anyone.

Protect your card details

Only give your debit card details when making purchases. Never reveal them for any other reason.

Check delivery and return policies

Before completing an online transaction, read the delivery and return policies on the online store's home page. Find out if you can return items and who bears the cost for the discrepancies. .

Never send payment information via email

Information that travels over the internet (such as email) is not fully protected from being read by outside parties. Most reputable merchant sites use encryption technologies that will protect your private data from being accessed by others as you conduct an online transaction.

Keep a record of your transactions

You should keep records of your online purchases. Back up your transaction by saving and/or printing the order confirmation.

Review your monthly account statement thoroughly

Monitor your monthly statements, especially after an overseas trip. Check all transactions, even the small ones, because criminals test out stolen accounts by buying inexpensive items rather than large ones.

Immediately report suspicious activity to prevent any possible additional fraud from occurring. Promptly notify us of any suspicious email activities.

Only open and respond to emails related to cards that pass some basic tests*

- Is the email from somebody you know?

- Have you received emails from this sender before?

- Were you expecting email with an attachment from this sender?

- Does email from this sender with the contents described in the subject line